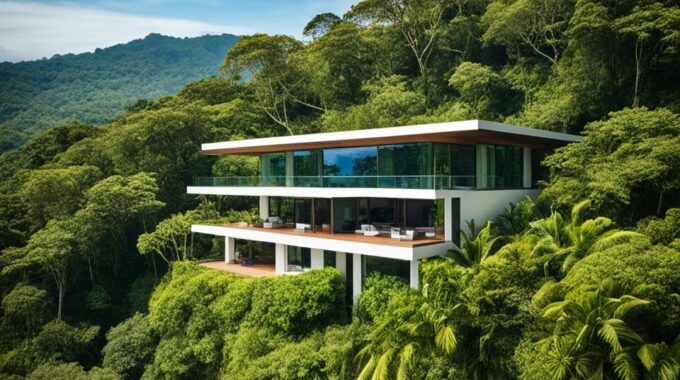

Explore private financing options in Costa Rica with GAP Equity Loans. We offer tailored solutions for real estate, businesses, and startups. Find private financing Costa Rica today.

Unlock Home Equity Loan Benefits Today!

We at GAP Equity Loans understand the financial chances your Costa Rican properties have. With the growing love for Costa Rica equity loans, we are among the top best equity loan providers. We aim to help you make the most of your home’s value. As a leading equity loan company in Costa Rica, we bridge your financial needs and the value in your real estate. With Costa Rican private gap equity lenders, we offer innovative and custom solutions like our home equity loan Costa Rica service. By picking us, you choose a partner who cares about your success. We provide flexible and easy financing.

Key Takeaways

- Homeowners can access the wealth trapped in their Costa Rican properties through GAP Equity Loans.

- GAP Equity Loans stands out among equity loan companies in Costa Rica for accepting low credit scores.

- Our loans are tailored with flexible repayment terms up to 10 years, providing a seamless borrowing experience.

- Our straightforward application process can be completed online or by phone, ensuring convenience and efficiency.

- As private gap equity lenders, we offer competitive loan amounts based on property value and existing mortgage debt.

- Partnering with us opens up the possibility of tapping into high loan amounts with potentially lower interest rates.

Exploring the Landscape of Home Equity Loans in Costa Rica

For homeowners in Costa Rica, many equity loan options are available. The number of reliable equity loan providers has grown, thanks to demand. Our study shows that getting affordable home equity loans is faster and easier now.

Costa Rica’s focus on fiscal health and innovative finance helps homeowners. The Fiscal Management Improvement Project, worth USD 156.64 million, boosted lender and borrower confidence. Also, a USD 500 million Development Policy Loan in 2023 supports the financial structure.

Homeowners enjoy using their home equity for important expenses. They can invest in home improvements, start a business, or pay off debts. And, there’s more money for green projects because of the trust funds.

The World Bank has helped improve the market by backing clean energy. This makes the housing market more appealing. It also increases home equity values.

More young people in Costa Rica are finishing college. This means they know more about finances. Education helps them make smart choices about equity loan options in Costa Rica.

| Financial Indicator | Statistic | Impact on Equity Loans |

|---|---|---|

| Net Commitments (Active Portfolio) | USD 1301.7 million | Shows a strong loan market |

| Development Policy Loans | USD 660 million | Lender attraction due to government fiscal support |

| GDP per capita (USD PPP) | $15,594 | Indicates good economic health and borrowing ability |

| Gini Coefficient | 0.48 | Loan terms may be affected by income inequality |

In conclusion, we’ve looked closely at home equity loans in Costa Rica. Government policies, better education, and international funding create great opportunities for homeowners.

GAP Equity Home Equity Benefits: An In-Depth Look

At GAP Equity Loans, we are experts in providing trusted equity loan lenders with competitive rates. We offer private and low interest equity loans, perfect for various financial needs. Visit us for private gap equity loans in Costa Rica.

We know how important flexible loan terms and conditions are. That’s why we’ve made getting Costa Rica property loans quite easy. Quick approval and flexible repayment are part of our service.

Advantages of GAP Equity Home Equity Loans

Working with GAP Equity Loans brings many benefits. You’ll understand home equity loan benefits easily. We make all equity loan benefits explained in simple terms.

Eligibility and Loan Terms Tailored to Your Needs

Finding the right loan options for you matters to us. We offer low-interest rates, ideal for unique opportunities or investing in secured loans Costa Rica.

Navigating the GAP Equity Loan Process

Our team will personally guide you from application to approval. Expect a fast, easy loan process, flexible repayment options, and top service from trusted equity loan lenders.

| Feature | GAP Equity Loans | Traditional Banks |

|---|---|---|

| Interest Rates | 12% – 16% | Avg. 14.21% |

| Funding Speed | 7 – 10 Business Days | Up to 6 Months – 1 Year |

| Approval Flexibility | Higher for Varied Income Histories | Lower |

| Loan Size | $50,000 USD to Millions | Varies |

| Loan Terms | 6 Months – 5 Years | Typically Longer |

| Minimum LTV for Lowest Rates | Under 30% | N/A |

| Closing Costs | Approx. 8% | Varies |

Comparing GAP Equity Loans to Traditional Financing Options

People looking for financial options in Costa Rica are considering the benefits of using home equity. Leveraging home equity advantages is gaining favor over classic bank methods. GAP Equity Loans offer specific plans that meet various financial needs, different from regular mortgage lenders in Costa Rica.

The key to understanding financial benefits of home equity is seeing how quick private equity lending can be. Our private lender partners can finalize and fund loans in just 7 to 10 business days. This is much faster than the six months to a year that banks usually take.

| Feature | GAP Equity Loans | Traditional Banks |

|---|---|---|

| Funding Speed | 7 – 10 business days | 6 months – 1 year |

| Loan Amount Range (USD) | $50,000 – $1,000,000+ | Varies, often lower cap |

| Interest Rates | 12% – 16% | Average of 14.21% (can be higher) |

| Loan Flexibility | High (asset-based loans) | Low (strict requirements) |

| Loan Types | Renovations, expansions, etc. | Typically more restrictive |

Leveraging home equity advantages means more than just looking at numbers. It gives a flexible borrowing method.

GAP Equity Loans provide commercial loans from $50,000 to over $1 million. We highlight the speed and easier approval when you borrow against home equity. This beats the long waits with regular banks.

Our interest rates vary from 12% to 16% depending on your loan’s value. Rates for projects can be the same or even less than banks.

Our loans are funded quickly and come with flexible terms. This is better than what most mortgage lenders in Costa Rica offer. We support various loan needs, from fixing up properties to increasing cash flow. This shows the wide range of GAP Equity Loans.

- Speed of funding surpasses traditional banks

- Flexible, negotiable loan terms

- Loans tailored for a variety of commercial needs

Overall, when looking at home equity loan advantages, GAP Equity Loans stand out. They offer competitive, personalized options. This helps homeowners and businesses get more financial freedom.

Maximizing Your Investment with Costa Rica Real Estate

In Costa Rica, private equity loans are a powerful way to grow investments by using property equity. Costa Rica’s private loans are key for reaching important financial and personal goals.

Leveraging Property Equity for Financial Progress

Private lenders in Costa Rica offer loans quickly, within just 7-10 business days. This is much faster than the 6-12 months that banks often take. Our loan services provide loans from $50,000 to over $1,000,000 USD. We capitalize on up to 50% of your property’s value, which gives great equity release benefits.

Enhancing Your Portfolio with Costa Rica’s Thriving Real Estate Market

Investing in Costa Rica’s real estate is exciting and offers great value increases. We, as private loan providers, enable access to funds for real estate projects with attractive rates. Our customers gain from investing in prime areas. Places like the Central Valley and the best beaches offer high returns.

Strategies for Optimizing GAP Equity Loan Benefits

By investing wisely and choosing the right lending options in Costa Rica, our clients achieve financial stability. We focus on the benefits of equity loans for funding small businesses or home improvements. Our specialties include bridge loans and home equity loans. They help clients make the most of mortgage refinancing benefits.

| Loan Feature | GAP Equity Loans | Traditional Banks |

|---|---|---|

| Funding Speed | 7-10 business days | 6 months to a year |

| Loan Amount | Up to $1,000,000+ | Varies |

| Interest Rates | 12% to 16% | Comparative Rates |

| LTV Ratio | Up to 50% | Varies |

| Loan Term | 6 to 36 months | Varies |

| Application Process | Simple, quick decision | Often complex |

Our goal is to unlock your property’s investment power. We value adaptability and vision in our loan services. Discover our expertise in financing Costa Rican real estate. Start your path to financial growth with us today.

Conclusion

As we wrap up, it’s clear that Grupo Gap leads in offering top financial services in Costa Rica. They focus on giving best loan options for homeowners. It’s more than just getting property loans; it’s about creating paths to wealth. Glenn Tellier works hard to make sure every client gets help that really improves their finances.

Lending options from Grupo Gap have lower interest rates and fees than most banks. Their loan terms vary from 6 months to 3 years. Choosing Grupo Gap for loans is smart. They guarantee quick funding in just 5 to 10 days. This makes them a great choice for quick financial help. Their interest-only loans offer a way to pay back that works for borrowers.

Grupo Gap has a lot of low-interest loans with great loan-to-value ratios. This offers big benefits to borrowers, giving them one of the best equity loan rates out there. Let’s turn our focus on improving the financial lives of property owners in Costa Rica. We invite you to check out home equity options with Grupo Gap, a trusted name in finance.

FAQ

What are GAP Equity Loans and how do they work in Costa Rica?

GAP Equity Loans let homeowners in Costa Rica use their property’s equity as loan collateral. They get cash upfront without monthly payments, in exchange for a portion of their property’s future value.

Who are the best equity loan providers in Costa Rica?

The top equity loan providers in Costa Rica offer good rates, easy terms, and fast approvals. GAP Equity Loans is known for its services to homeowners needing private loans with less strict credit checks.

What are the advantages of using GAP Equity Home Equity Loans over traditional loans?

With GAP Equity Loans, you get cash without monthly payments or interest, even with low credit. They offer flexible payback options and let you borrow more based on your property’s value. This makes them more tailored to individual needs than regular loans.

What are the eligibility requirements for a GAP Equity Loan in Costa Rica?

To qualify for a GAP Loan, you need enough home equity, an acceptable credit score, and a clear plan for the funds. While these loans are more flexible about credit scores, your property’s value and any debts affect your loan terms.

How does one navigate the GAP Equity Loan process?

For a GAP Loan, just provide details about your home and finances either online or by phone. It’s a simple process with application, approval, and funding steps designed to be user-friendly.

How do GAP Equity Loans compare to traditional financing options in Costa Rica?

GAP Loans offer more flexibility than traditional loans, with no need for monthly payments or interest. They’re open to more people, including those with lower credit, and have terms that can be adjusted based on your financial situation.

How can GAP Equity Loans maximize my investment in Costa Rican real estate?

GAP Loans provide money for property upgrades, expanding your investment, or seizing market opportunities in Costa Rica. This boosts your property value and financial security.

What are some strategies for optimizing the benefits of GAP Equity Loans?

To make the most of GAP Loans, think about using them to raise your property’s value, pay off high-interest debt, or invest in high-return projects. Planning your loan around your financial goals enhances its benefits.

Source Links

- https://www.renofi.com/home-equity-loan/can-you-pay-off-a-home-equity-loan-early/

- https://www.canada.ca/en/financial-consumer-agency/programs/research/home-equity-lines-credit-trends-issues.html

- https://capeanalytics.com/blog/home-equity-lending-ai-property-insights/

- https://www.worldbank.org/en/country/costarica/overview

- https://www.oecd.org/education/school/Education-in-Costa-Rica-Highlights.pdf

- https://www.gapequityloans.com/en/construction-loans/

- https://www.gapequityloans.com/en/equity-loans-faq/

- https://www.earthmovercu.com/about/blog/blog/2023/10/05/home-equity–everything-you’ve-ever-wanted-to-know

- https://www.cbsnews.com/news/benefits-using-home-equity-according-to-pros/

- https://www.gapequityloans.com/en/commercial-loans/

- https://www.renofi.com/heloc/bridge-loan-vs-heloc/

- https://www.bankrate.com/home-equity/home-equity-lenders-launch-new-heloc-and-loan-products/

- https://www.gapequityloans.com/en/costa-rica-home-equity-loans/

- https://www.gapequityloans.com/en/referral-program/

- https://www.oecd.org/costarica/E-book FDI to Costa Rica.pdf

- https://crie.cr/costa-rica-investment-property/

- https://www.gapequityloans.com/en/about-us/

- https://www.commercebank.com/personal/ideas-and-tips/2024/why-and-how-homeowners-build-equity

- https://themreport.com/news/data/08-24-2023/home-equity-obvious-solution

Article by Glenn Tellier (Founder of CRIE and Grupo Gap)