Discover expert property investment financing in Costa Rica with GAP Equity Loans. We offer tailored solutions for foreign investors and expats seeking real estate opportunities.

Mortgages for Vacation Homes: A Comprehensive Guide With Gapequityloans.com

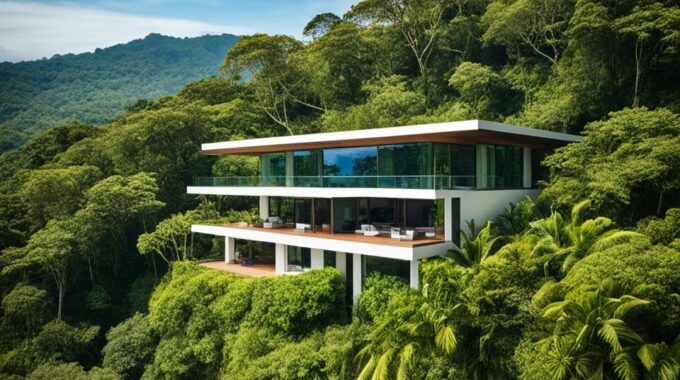

Unlock the financial potential of your vacation home with GapEquityLoans.com. Whether you’re looking to buy near the beach, in the mountains, or by a lake, we can help. We have custom financing options to turn your vacation home dreams into reality.

Understanding that getting mortgages for these types of homes can be tricky, we’re here to help. GapEquityLoans.com offers a range of lending services. These include loans for vacation rentals, luxury vacation homes, and more. We aim to meet your specific needs.

Please take a look at our varied financing choices and competitive rates. GapEquityLoans.com is here to simplify your journey towards owning a vacation home in Costa Rica. With our customized services, turning your property into an investment has never been easier.

Key Takeaways

- Secure financing for undeveloped land in Costa Rica with GapEquityLoans.com

- Explore flexible commercial real estate financing options for your property investments and acquisitions

- Leverage our tailored lending solutions for vacation homes, investment properties, and non-owner-occupied residences

- Benefit from competitive interest rates and flexible loan terms to suit your financial needs

- Unlock the full potential of your getaway property with the help of our expert team

Unlock the Potential of Your Vacation Home With GapEquityLoans.com

Looking for low-interest loans on your property in Costa Rica’s Escazu? Gap Equity Loans can help. They are among the top equity loan providers in Costa Rica. They work with individuals and businesses alike to make borrowing easy with quick approvals. Their loans cover a wide range of options, from bridging gaps in short terms to long-term financing needs.

Flexible Financing Options for Your Getaway Dreams

Want to own a beachfront rental, upgrade your mountain home, or buy a lakefront place? Gap Equity Loans has you covered with a variety of financial options. They offer loans from $50,000 to $3,000,000+ USD and flexible repayment periods of 6 to 36 months. This allows you to tailor your loan to best suit your vacation property dreams.

Competitive Interest Rates and Loan Terms

At Gap Equity Loans, they consider your financial comfort important. With loan rates usually between 12% to 16% yearly, they’re often cheaper than banks. They make it easy to get your money too, with approvals in 5 to 10 days. This is much quicker than the 3 to 6 months other places take. So, whether it’s for a second home or an investment, they aim to offer great rates and terms.

Understanding Equity Loans and Financing Options in Costa Rica

Many people in Costa Rica use home equity loans to get money by using the value of their property. This is the extra value that property has, beyond the loan they still owe. With Gap Equity Loans, homeowners can borrow up to half of their home’s value.This gives them access to big amounts of money. Plus, they get to pick how much they need and have the advantage of low-interest loans.

What Are Home Equity Loans?

Getting a loan based on your home’s equity in Costa Rica is pretty simple. As long as you meet the requirements, it’s easy to apply. Things like your credit, how much your home is worth, and having a job are looked at. If you qualify, you can borrow up to $1,000,000.

The Role of Grupo Gap in Costa Rica’s Equity Loan Market

Gap Equity Loans is not like the usual mortgage companies in Costa Rica. They are known for being quick with their money and offering different types of loans. Hence, they are very important for homeowners who need loans.

The Advantages of Equity Loans for Property Owners

Homeowners who use equity loans can get a lot of money for their needs. This is different from regular mortgages because it has lower interest. It also allows for easy ways to pay it back.

Mortgages for Vacation Homes: Navigating the Process

Getting a loan in Escazu, Costa Rica, means checking many things. The value of the property, how good your credit is, and your income matter a lot. You must show clear proof of owning the property, its value, and your income.

Collateral Requirements: Using Costa Rican Property

Collateral is crucial for an equity loan. The value of the property and how much you’ve paid down make a big difference. Gap Equity Loans are open to all kinds of properties. This includes homes, businesses like restaurants and gas stations.

Navigating the Application Process with GapEquityLoans.com

The process with Gap Equity Loans is easy for borrowers. It all starts with looking at your finances and the property’s worth. Then, you fill out an application with personal and financial info.

Repayment Terms and Interest Rate Considerations

At Gap Equity Loans, you can repay your loan in 6 months to 3 years. This offers a lot of flexibility. Your interest rate depends on how much you want to borrow and your credit. It can range from 12% to 16%.

Why Choose GapEquityLoans.com for Your Vacation Home Financing?

Looking to finance your vacation home in Costa Rica? GapEquityLoans.com offers easy loan processes and fair interest rates. They’ve helped many property owners tap into their property’s value. Their expertise is renowned in the Costa Rican market.

Streamlined Loan Application Process

Applying for a loan with GapEquityLoans.com is easy and quick. Most traditional banks take ages, but GapEquityLoans.com closes loans in 7 to 10 days. They achieve this by partnering with private lenders focused on success and preventing foreclosure.

Testimonials and Success Stories

The experiences shared by GapEquityLoans.com clients highlight their success. Clients rave about the fast service, fair rates, and the team’s expertise. Positive client feedback establishes them as a premier equity loan provider Costa Rica.

Optimizing Your Vacation Home Equity Loan Experience

We know how important it is to get the right loan for your vacation home, second home, or investment property. That’s why we start by accurately assessing your property’s value. Our team uses the latest tools to find your Costa Rican real estate’s true worth. This way, you can get the best loan terms and the financing you need.

Assessing Costa Rica Property Value for Optimal Loan Terms

We are experts in the Costa Rican real estate market. This allows us to review your vacation home loan needs with precision. With our knowledge, you can trust that your loan terms match your property’s real value. This helps you get the resort property loan or recreational mortgage you require.

Advantages of GapEquityLoans.com Expertise

At GAP Equity Loans, our deep local market knowledge leads to quick loan processes and flexible terms. We offer top-notch rates for Costa Rican homeowners looking to fund their plans. Whether it’s for your vacation house or second home, our team is here to help. We aim to provide the best experience for those looking for investment property loans, vacation rental funds, or any other luxury vacation home loans.

Conclusion

Living in Costa Rica and need extra cash? Here’s a great choice. Equity loans offer a smart way to borrow money. You can turn your home’s value into funds for various needs.

Call To See If You Qualify For a Loan Today

Gap Equity Loans know their stuff. They can loan you from $50,000 USD to more than $1,000,000 USD. It all depends on how much your home is worth. Loan terms go from 6 to 36 months. Plus, these private lenders work fast. Your loan could be good to go in 7 to 10 days.

Interest rates are usually between 12% and 16%. You might be able to get half your property’s value as a loan. This can help with costs for a vacation home, rental property, or other real estate projects in Costa Rica.

FAQ

What types of vacation homes can I get financing for with GapEquityLoans.com?

At GapEquityLoans.com, you can finance various vacation homes. This includes beach houses, mountain cabins, and lake houses. We also cater to getaway homes, resort properties, and more. These loans work for those investing in real estate personally or commercially.

What are the typical interest rates and loan terms for vacation home mortgages with GapEquityLoans.com?

Our typical interest rates for these vacation homes range from 12% to 16%. Loan terms can be from 6 months to 3 years. These numbers can change based on how much the loan is in comparison to the property’s value and the borrower’s credit score.

How does the equity loan process work for vacation properties in Costa Rica?

For a loan in Costa Rica, we will look at how much the property is worth, check your credit, and ask for proof of your income. You’ll need to show documents that confirm you own the property, provide a property appraisal, and proof of your income. The property itself is used as security, and that can be either a house or a business property.

What are the benefits of using GapEquityLoans.com for vacation home financing?

GapEquityLoans.com makes it easy to apply for a loan with quick funding in 7-10 business days. Our interest rates are competitive. We know the Costa Rican real estate market well. This lets us offer the best loan options for your vacation home.

Can I use an equity loan to finance an Airbnb or vacation rental property?

Yes, at GapEquityLoans.com, you can get a loan for vacation rentals that make you money. This includes Airbnb properties and timeshares. We understand how these investments work and what you need to finance them.

How much can I borrow against the equity in my vacation home?

With GapEquityLoans.com, you can get a loan from ,000 USD to over What types of vacation homes can I get financing for with GapEquityLoans.com?At GapEquityLoans.com, you can finance various vacation homes. This includes beach houses, mountain cabins, and lake houses. We also cater to getaway homes, resort properties, and more. These loans work for those investing in real estate personally or commercially.What are the typical interest rates and loan terms for vacation home mortgages with GapEquityLoans.com?Our typical interest rates for these vacation homes range from 12% to 16%. Loan terms can be from 6 months to 3 years. These numbers can change based on how much the loan is in comparison to the property’s value and the borrower’s credit score.How does the equity loan process work for vacation properties in Costa Rica?For a loan in Costa Rica, we will look at how much the property is worth, check your credit, and ask for proof of your income. You’ll need to show documents that confirm you own the property, provide a property appraisal, and proof of your income. The property itself is used as security, and that can be either a house or a business property.What are the benefits of using GapEquityLoans.com for vacation home financing?GapEquityLoans.com makes it easy to apply for a loan with quick funding in 7-10 business days. Our interest rates are competitive. We know the Costa Rican real estate market well. This lets us offer the best loan options for your vacation home.Can I use an equity loan to finance an Airbnb or vacation rental property?Yes, at GapEquityLoans.com, you can get a loan for vacation rentals that make you money. This includes Airbnb properties and timeshares. We understand how these investments work and what you need to finance them.How much can I borrow against the equity in my vacation home?With GapEquityLoans.com, you can get a loan from ,000 USD to over ,000,000 USD, based on your property’s worth. Normally, we approve loans up to half the value of your property.,000,000 USD, based on your property’s worth. Normally, we approve loans up to half the value of your property.

FAQ

What types of vacation homes can I get financing for with GapEquityLoans.com?

At GapEquityLoans.com, you can finance various vacation homes. This includes beach houses, mountain cabins, and lake houses. We also cater to getaway homes, resort properties, and more. These loans work for those investing in real estate personally or commercially.

What are the typical interest rates and loan terms for vacation home mortgages with GapEquityLoans.com?

Our typical interest rates for these vacation homes range from 12% to 16%. Loan terms can be from 6 months to 3 years. These numbers can change based on how much the loan is in comparison to the property’s value and the borrower’s credit score.

How does the equity loan process work for vacation properties in Costa Rica?

For a loan in Costa Rica, we will look at how much the property is worth, check your credit, and ask for proof of your income. You’ll need to show documents that confirm you own the property, provide a property appraisal, and proof of your income. The property itself is used as security, and that can be either a house or a business property.

What are the benefits of using GapEquityLoans.com for vacation home financing?

GapEquityLoans.com makes it easy to apply for a loan with quick funding in 7-10 business days. Our interest rates are competitive. We know the Costa Rican real estate market well. This lets us offer the best loan options for your vacation home.

Can I use an equity loan to finance an Airbnb or vacation rental property?

Yes, at GapEquityLoans.com, you can get a loan for vacation rentals that make you money. This includes Airbnb properties and timeshares. We understand how these investments work and what you need to finance them.

How much can I borrow against the equity in my vacation home?

With GapEquityLoans.com, you can get a loan from ,000 USD to over

FAQ

What types of vacation homes can I get financing for with GapEquityLoans.com?

At GapEquityLoans.com, you can finance various vacation homes. This includes beach houses, mountain cabins, and lake houses. We also cater to getaway homes, resort properties, and more. These loans work for those investing in real estate personally or commercially.

What are the typical interest rates and loan terms for vacation home mortgages with GapEquityLoans.com?

Our typical interest rates for these vacation homes range from 12% to 16%. Loan terms can be from 6 months to 3 years. These numbers can change based on how much the loan is in comparison to the property’s value and the borrower’s credit score.

How does the equity loan process work for vacation properties in Costa Rica?

For a loan in Costa Rica, we will look at how much the property is worth, check your credit, and ask for proof of your income. You’ll need to show documents that confirm you own the property, provide a property appraisal, and proof of your income. The property itself is used as security, and that can be either a house or a business property.

What are the benefits of using GapEquityLoans.com for vacation home financing?

GapEquityLoans.com makes it easy to apply for a loan with quick funding in 7-10 business days. Our interest rates are competitive. We know the Costa Rican real estate market well. This lets us offer the best loan options for your vacation home.

Can I use an equity loan to finance an Airbnb or vacation rental property?

Yes, at GapEquityLoans.com, you can get a loan for vacation rentals that make you money. This includes Airbnb properties and timeshares. We understand how these investments work and what you need to finance them.

How much can I borrow against the equity in my vacation home?

With GapEquityLoans.com, you can get a loan from $50,000 USD to over $1,000,000 USD, based on your property’s worth. Normally, we approve loans up to half the value of your property.

,000,000 USD, based on your property’s worth. Normally, we approve loans up to half the value of your property.

Source Links

- https://www.gapequityloans.com/en/flexible-home-loans-in-costa-rica/

- https://www.gapequityloans.com/en/how-to-buy-a-home-in-costa-rica-with-a-private-lender/

- https://www.gapequityloans.com/en/equity-loans-for-homeowners-in-costa-rica/

- https://www.gapequityloans.com/en/benefits-of-a-home-equity-loan-in-costa-rica/

- https://www.gapequityloans.com/en/mortgage-loans-for-vacation-homes/

- https://www.tresamigos-cr.com/financing-property-costa-rica

- https://osatropicalproperties.com/blog/real-estate-financing-in-costa-rica-can-you-get-a-mortgage-for-a-home-in-costa-rica

- https://www.specialplacesofcostarica.com/blog/how-to-get-a-mortgage-in-costa-rica/

- https://www.gapequityloans.com/en/commercial-loans/

- https://www.gapequityloans.com/en/costa-rica-home-equity-loans/

- https://www.bankrate.com/mortgages/how-to-buy-a-vacation-home/

- https://www.gapequityloans.com/en/construction-loans/

- https://www.gapequityloans.com/en/equity-loans-faq/

- https://gapinvestments.com/en/secure-loans-in-costa-rica/

- https://www.azibo.com/blog/buying-vacation-rental-property

- https://www.bnlappraisal.com/blog/how-to-get-a-mortgage-for-a-vacation-home

- https://www.uplisting.io/blog/guide-to-buying-vacation-rental-property-maximising-investment-opportunities

- https://www.gapequityloans.com/en/costa-rica-home-equity-loans-guide/

- https://www.gapequityloans.com/en/loan-application-costa-rica/

- https://www.investopedia.com/how-to-finance-a-vacation-home-7484955

- https://www.rocketmortgage.com/learn/buying-a-vacation-home

Article by Glenn Tellier (Founder of CRIE and Grupo Gap)