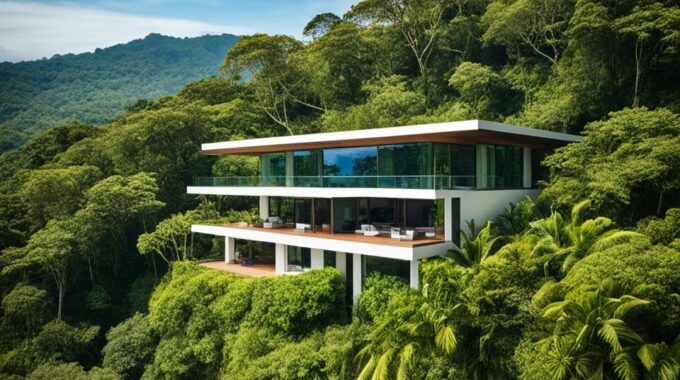

Discover expert property investment financing in Costa Rica with GAP Equity Loans. We offer tailored solutions for foreign investors and expats seeking real estate opportunities.

Costa Rica’s Beacon of Financial Trust: GAP Equity Loans

When it comes to finding a trusted financial institution in Costa Rica, look no further than GAP Equity Loans. With their low interest rates and secure loan options, they have established themselves as a beacon of financial trust. Borrowers can count on GAP Equity Loans for reliable lending services and flexible repayment plans. Plus, their easy loan application process and hassle-free loan approvals make borrowing a breeze. As a reputable loan provider, GAP Equity Loans offers competitive loan terms that cater to the specific needs of borrowers.

Key Takeaways:

- GAP Equity Loans is a trusted financial institution in Costa Rica.

- They offer secure loan options with low interest rates.

- Borrowers can rely on GAP Equity Loans for reliable lending services.

- Flexible repayment plans are available.

- Applying for a loan with GAP Equity Loans is easy and hassle-free.

Using Your Costa Rican Property as Collateral

In Costa Rica, borrowers who own property can utilize it as collateral to secure a loan through GAP Equity Loans. This option allows borrowers to access funds starting from $50,000 and up. With interest rates ranging from 12% to 16%, borrowers can find a competitive rate that suits their financial needs.

GAP Equity Loans offers flexible loan terms, allowing borrowers to choose a repayment plan that works best for them. Whether it’s a shorter term of 6 months or a longer term of 3 years, borrowers have the flexibility to select the duration that aligns with their financial goals.

By using their Costa Rican property as collateral, borrowers can benefit from the reliable lending services provided by GAP Equity Loans. The application process is straightforward and hassle-free, ensuring a quick approval process. With GAP Equity Loans, borrowers can feel confident in their borrowing decision, knowing they are working with a trusted financial institution in Costa Rica.

Benefits of Using Your Property as Collateral

By leveraging their property as collateral, borrowers can unlock the potential of their valuable assets. This allows them to access larger loan amounts and enjoy lower interest rates compared to other loan options available in Costa Rica.

| Loan Details | Amount | Interest Rate | Term |

|---|---|---|---|

| Minimum | $50,000 | 12% | 6 months |

| Maximum | Varies | 16% | 3 years |

Using your Costa Rican property as collateral with GAP Equity Loans provides borrowers with the opportunity to unlock the financial potential of their assets and access the funds they need. With competitive interest rates and flexible loan terms, borrowers can achieve their goals with confidence.

Challenges of Mortgage Loans in Costa Rica

When it comes to mortgage loans in Costa Rica, borrowers often face a set of unique challenges. From a stringent approval process to limited flexibility and long processing times, navigating the mortgage loan landscape can be daunting. In addition, property restrictions further complicate the borrowing process, making it crucial for borrowers to be well-informed before pursuing a traditional mortgage loan.

One of the main challenges borrowers encounter is the stringent approval process. Lenders in Costa Rica have strict criteria for approving mortgage loans, including thorough background checks and detailed financial documentation. This can lead to delays and frustrations for borrowers, as the approval process can take longer than expected.

Another challenge is the limited flexibility offered by traditional mortgage loans. Borrowers may find themselves bound to rigid terms and conditions, leaving little room for negotiation or customization based on individual needs. This lack of flexibility can make it difficult for borrowers to find a loan that aligns with their specific financial goals and circumstances.

In addition, mortgage loans in Costa Rica often come with long processing times. The complex procedures involved in securing a mortgage loan can result in significant delays, causing frustration for borrowers who are looking for a quick and efficient borrowing experience.

Lastly, property restrictions add another layer of challenge to mortgage loans in Costa Rica. Certain types of properties may not be eligible for mortgage financing, limiting the options available to borrowers. This can pose difficulties for individuals looking to purchase a specific property or invest in real estate.

Overall, it is important for borrowers in Costa Rica to be aware of these challenges when considering a traditional mortgage loan. Understanding the potential hurdles can help borrowers make informed decisions and explore alternative financing options that may better suit their needs.

The Gap Equity Loans Difference

Gap Equity Loans offers a range of flexible loan options in Costa Rica, setting itself apart from traditional mortgage loans. With Gap Equity Loans, borrowers can expect personalized service, a quick approval process, and competitive rates. These key factors make Gap Equity Loans a preferred choice for many borrowers in Costa Rica.

When it comes to borrowing money, having flexibility is essential. Gap Equity Loans understands this and provides borrowers with various loan options tailored to their specific needs. Whether you’re looking to fund a home renovation, consolidate debt, or invest in a business venture, Gap Equity Loans has flexible loan terms that can accommodate your financial goals.

Personalized service is another distinguishing feature of Gap Equity Loans. The team at Gap Equity Loans takes the time to understand each borrower’s unique circumstances and financial objectives. They work closely with borrowers to find the best loan solution and offer guidance throughout the borrowing process, ensuring a smooth and personalized experience.

One of the frustrations borrowers often face is a lengthy approval process. With Gap Equity Loans, borrowers can enjoy a quick approval process, providing them with the funds they need in a timely manner. This efficiency sets Gap Equity Loans apart from traditional mortgage lenders, who may take weeks or even months to approve a loan.

In addition to personalized service and a quick approval process, Gap Equity Loans offers competitive rates. By keeping their rates competitive, Gap Equity Loans ensures that borrowers can access affordable financing while still meeting their financial goals.

Overall, Gap Equity Loans stands out in Costa Rica as a reputable lender that offers flexible loan options, personalized service, a quick approval process, and competitive rates. Whether you’re a homeowner looking to leverage the equity in your property or a borrower in need of reliable lending services, Gap Equity Loans is a trusted choice.

Making the Right Loan Decision

When it comes to borrowing in Costa Rica, making the right decision is crucial. With Gap Equity Loans, borrowers have the opportunity to maximize their home equity and achieve their financial goals.

With Gap Equity Loans, secure borrowing is prioritized. Borrowers can trust in the reliability and reputation of this trusted financial institution. By leveraging their home equity, borrowers can access the funds they need while enjoying competitive rates and flexible loan options.

By choosing Gap Equity Loans, borrowers can make an informed choice. The application process is hassle-free, with quick approvals, allowing borrowers to access the funds they need when they need them. With personalized service and a commitment to customer satisfaction, Gap Equity Loans ensures a secure and reliable lending experience for all borrowers.

FAQ

What types of loans does GAP Equity Loans offer?

GAP Equity Loans offers secure loan options with low interest rates, allowing borrowers to use their property as collateral to secure a loan.

What is the loan application process like with GAP Equity Loans?

The loan application process with GAP Equity Loans is easy and hassle-free, with quick approvals.

What are the loan terms and interest rates offered by GAP Equity Loans?

GAP Equity Loans offers flexible repayment plans with loan terms ranging from 6 months to 3 years. Interest rates range from 12% to 16%.

How does GAP Equity Loans differ from traditional mortgage loans in Costa Rica?

GAP Equity Loans stands out from traditional mortgage loans by offering personalized service and flexible loan options, ensuring a quick approval process and competitive rates.

Why is it important to make the right loan decision in Costa Rica?

Making the right loan decision with GAP Equity Loans allows borrowers to maximize their home equity and achieve their financial goals, ensuring a secure and reliable lending experience.

Article by Glenn Tellier (Founder of CRIE and Grupo Gap)