Get expert guidance on hard-money-loans-for-property-renovations in Costa Rica. We offer lower fees, competitive rates, and loan terms from 6 months to 3 years

Asset Loans for Equipment in Costa Rica: GAP Solutions

Have you ever thought about how businesses in Costa Rica can grow by using what they already have? With an asset loan for equipment in Costa Rica, thanks to GAP Solutions, companies can get financing that fits their needs. We offer special financing options that let businesses use their real estate and other valuable assets to get the funds they need for new equipment.

Our loans range from $50,000 to over $1 million, with interest rates starting at just 12%. Using these financing options can help businesses grow and work more efficiently.

Key Takeaways

- GAP Solutions offers competitive terms for asset loans tailored for equipment purchases.

- Leverage real estate and assets to secure much-needed financing.

- Access loans ranging from $50,000 to over $1 million, making it suitable for various business sizes.

- Enjoy flexible repayment options with competitive interest rates starting at 12%.

- Utilizing equipment financing in Costa Rica can significantly boost operational effectiveness.

Introduction to Asset Loans in Costa Rica

In Costa Rica, asset loans are a great way to get financing for businesses and individuals. They help us grow our operations or start new projects. By using things like machinery or real estate as collateral, we can get big loans quickly.

These loans are known for their flexibility and fast approval. Knowing about asset loans helps us choose the right financing for our needs. For those looking into equipment financing options in Costa Rica, the benefits are obvious.

Asset loans are among the top choices in Costa Rica, even for those with limited credit. As the economy grows, using these loans helps us stay ahead in our fields.

Understanding Asset Loans for Equipment in Costa Rica

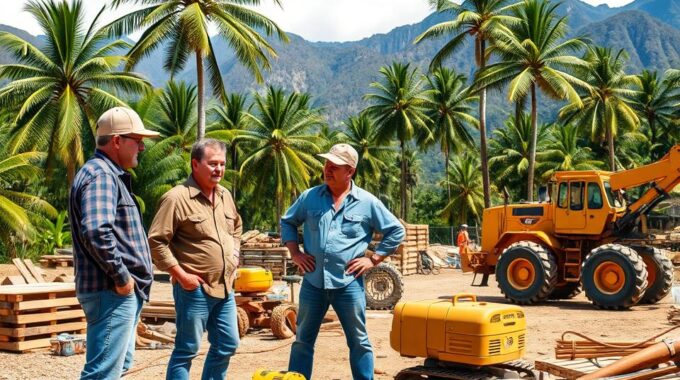

Asset loans for equipment in Costa Rica let businesses borrow against things like machinery or real estate. These loans can be big, starting at $50,000 and going over $1 million. This way, companies can get the money they need for equipment without the usual loan rules.

We look at the real value of the assets, not just credit scores. This means businesses can get the funds they need quickly. Many types of assets can be used as collateral, including soft assets like computer software and office furniture.

Our financing process is easy and fits the needs of many industries. We work with top institutions to offer flexible loan terms and quick approvals. This helps businesses make smart choices about their equipment financing.

Benefits of Using GAP Solutions for Equipment Financing

Choosing GAP Solutions for equipment financing has many benefits. We make it easier to get the money you need. Plus, we tailor the terms to fit your business perfectly.

Competitive Interest Rates

Getting low interest equipment loans in Costa Rica with GAP Solutions is a big plus. Our rates start at 12% a year. This helps businesses manage their payments better.

Our rates can go up to 16%. This means you can borrow more and still stay within your budget. It’s great for growing or buying new equipment.

Flexible Loan Terms

We offer loans with terms you can adjust. You can choose from 6 months to 3 years. This flexibility is perfect for businesses with changing cash flows.

By picking the right term, you can handle your payments easily. This makes it easier to plan your finances. It’s a big plus for those looking at loan options in Costa Rica.

Types of Loans Available for Equipment in Costa Rica

Exploring financing options for businesses is key. In Costa Rica, there are many loans for equipment needs. These loans offer benefits and can help businesses grow. GAP Equity Loans and other options provide flexibility and access for companies.

GAP Equity Loans

GAP Equity Loans are great for using real estate as collateral. They allow us to borrow up to 50% of a property’s value. This helps get big loans for equipment and meets other business needs. It’s a good choice for growing businesses.

Alternative Equipment Financing Options

Costa Rica has many equipment financing options. Hard money loans and private lender loans have different terms and rates. This means we can find the best loan for our needs. With 92% of SMEs open to new lenders, these options meet specific business needs.

Eligibility and Application Process for Asset Loans

If you’re thinking about getting an asset loan in Costa Rica, knowing what you need is key. At GAP Solutions, we make it easy. We focus on your property and how much money it could make.

Required Documentation

To start your loan application, we need some important documents. These show you’re eligible for a loan in Costa Rica. You’ll need:

- Property deeds

- Tax records

- Proof of homeownership

- Recent financial statements

Having these documents ready can make things go faster. It helps us get through the application quickly.

Evaluating Financial Health

At GAP Solutions, we look at your financial health in a different way. We consider your assets and income, not just your credit score. This makes it easier to get a loan, thanks to our Costa Rica loan comparison.

We can fund loans in just 7-10 business days. This is much faster than traditional banks. Our approach means quicker approvals and a better chance of getting a loan, even if you’re self-employed or have a short work history.

Loan Costs with GAP Equity Loans in Costa Rica

Knowing the loan costs with GAP Equity Loans is key for smart financial planning in Costa Rica. At GAP, our loan fees in Costa Rica are about 8% of the loan’s total value. This is better than traditional banks, which might charge 3% to 5% extra. Choosing GAP means more money for your projects.

It’s important to understand equity loan expenses to manage your finances well. We make sure you know all the costs upfront. This way, you can plan your finances better.

High financing costs can really affect businesses, like MSMEs, which need $5.2 trillion a year. Making smart choices about loan costs with GAP Equity Loans can help your business grow and stay strong.

Conclusion

Asset loans for equipment in Costa Rica from GAP Solutions are key for businesses looking to grow. These loans offer competitive rates and flexible terms. They help companies use valuable assets to get the funding they need.

Our application process is easy, so businesses can focus on growing. Whether you need equipment for manufacturing or construction, our loans make it easier to invest in your future. Visit our page on GAP Equity Loans to learn more.

With Costa Rica’s economy growing, now is a great time to look at financing options. Choosing GAP Solutions for your equipment loans means you’re ready for the future. You’ll have the resources to succeed in this changing world.

Article by Glenn Tellier (Founder of CRIE and Grupo Gap)