We provide expert guidance on Costa Rica residential property loans, helping you secure financing for your dream home or investment property.

Private Loans for Exclusive Financial Scenarios in Costa Rica With GAP Equity Loans

Exclusive Private Lending for Unique Financial Needs

This comprehensive guide explores exclusive private lending opportunities, qualification requirements, loan structures, and the advantages of working with GAP Equity Loans for your most sophisticated financial needs in Costa Rica.

Exclusive Financial Scenarios We Serve

Our private lending program addresses sophisticated financial needs:

Luxury Real Estate Acquisitions

Financing for premium properties, oceanfront estates, and exclusive developments that require specialized underwriting and flexible terms.

International Investment Structures

Complex cross-border transactions involving multiple entities, currencies, and jurisdictions require sophisticated loan structures.

Portfolio Diversification

Strategic financing for high-net-worth individuals expanding their Costa Rica investment portfolios with multiple properties or business ventures.

Time-Sensitive Opportunities

Rapid financing for exclusive investment opportunities that require immediate capital deployment and quick decision-making.

Privacy-Focused Transactions

Confidential lending arrangements for clients requiring discretion in their financial affairs and property acquisitions.

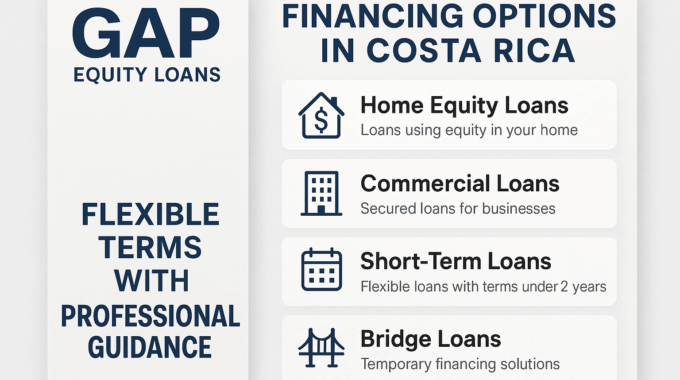

Exclusive Private Loan Programs

Customized lending solutions for sophisticated borrowers:

Ultra-High-Value Property Loans

Financing for luxury properties valued at $1 million and above, with loan amounts up to $10 million or more.

- Loan amounts: $1M – $10M+

- Loan-to-value: Up to 70%

- Terms: 1-10 years

- Interest-only options available

International Investor Programs

Specialized lending for foreign nationals and international investors with complex financial structures.

- Multi-currency options

- Cross-border structuring

- Entity-based lending

- Flexible documentation requirements

Portfolio Expansion Financing

Credit facilities for acquiring multiple properties or expanding existing real estate portfolios.

- Revolving credit lines

- Blanket mortgage options

- Cross-collateralization structures

- Staged funding arrangements

Bridge and Transitional Financing

Short-term financing for property transitions, renovations, or strategic repositioning.

- Terms: 6 months – 3 years

- Interest-only payments

- Renovation funding included

- Exit strategy flexibility

Advantages of Exclusive Private Lending

Benefits that distinguish our exclusive lending program:

Discretion and Confidentiality

Complete privacy protection with confidential loan processing, discreet property evaluations, and secure documentation handling.

Customized Loan Structures

Loan terms designed to match your specific financial objectives, cash flow requirements, and investment strategies.

Rapid Decision Making

Streamlined approval processes with senior-level decision makers who understand complex financial scenarios and can move quickly.

Flexible Qualification Criteria

Asset-based underwriting that focuses on collateral value and borrower sophistication rather than traditional income verification.

Relationship-Based Service

Dedicated relationship managers who understand your financial goals and provide ongoing support for current and future needs.

International Expertise

Deep understanding of cross-border transactions, international tax considerations, and multi-jurisdictional lending requirements.

Qualification and Application Process

Our exclusive lending program serves sophisticated borrowers who meet specific criteria:

Borrower Profile

Net Worth Requirements: Minimum $2 million net worth with substantial liquid assets and diversified investment portfolios.

Investment Experience: Demonstrated experience in real estate investing, international transactions, or sophisticated financial structures.

Asset Quality: High-quality collateral properties in prime Costa Rica locations with strong market fundamentals.

Documentation Requirements

Financial Documentation:

- Personal financial statements

- Asset verification and valuations

- Income documentation (if applicable)

- Investment portfolio statements

Property Documentation:

- Property appraisals and valuations

- Title reports and legal documentation

- Environmental assessments (if required)

- Insurance coverage verification

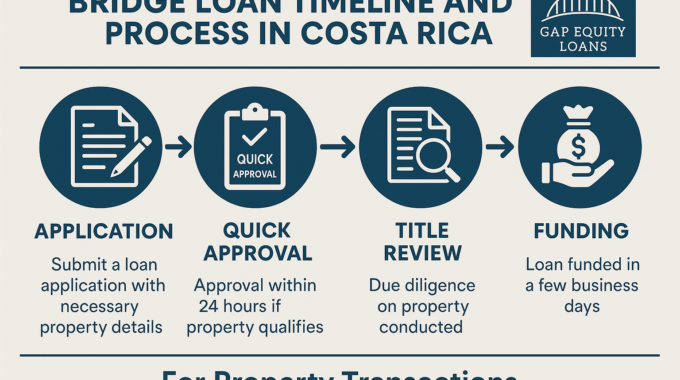

Application Process

Step 1: Confidential initial consultation and needs assessment

Step 2: Preliminary loan structuring and terms discussion

Step 3: Formal application and documentation submission

Step 4: Property evaluation and due diligence

Step 5: Final underwriting and loan approval

Step 6: Closing coordination and funding

GAP Equity Loans Exclusive Lending Advantage

Why sophisticated borrowers choose GAP Equity Loans for exclusive private lending:

Market Leadership

Over 15 years of experience serving high-net-worth clients in Costa Rica’s luxury real estate market with a proven track record of successful transactions.

Local Expertise

Deep knowledge of Costa Rica’s luxury property markets, legal requirements, and investment opportunities that benefit sophisticated investors.

Relationship Focus

A long-term relationship approach that provides ongoing financial solutions as your investment portfolio and needs evolve over time.

Professional Network

Established relationships with luxury real estate professionals, legal experts, and financial advisors who serve high-net-worth clients.

Flexible Capital Sources

Access to diverse private capital sources that enable large loan amounts and flexible terms for unique financial scenarios.

Frequently Asked Questions (FAQ)

1. What qualifies as an exclusive financial scenario?

Exclusive scenarios include luxury property acquisitions over $1 million, complex international transactions, portfolio expansion financing, time-sensitive opportunities, and situations requiring high levels of discretion and customization.

2. What are the minimum loan amounts for exclusive private lending?

Our exclusive private lending program typically starts at $500,000, with most loans ranging from $1 million to $10 million or more, depending on the property value and borrower qualifications.

3. How quickly can exclusive private loans be approved and funded?

With complete documentation anda clear property title, exclusive private loans can be approved in 1-2 weeks and funded within 3-4 weeks, significantly faster than traditional bank financing.

4. Do you work with foreign nationals and international investors?

Yes, we specialize in serving international investors and foreign nationals with sophisticated lending structures that accommodate cross-border transactions and complex entity ownership.

5. What level of discretion and confidentiality do you provide?

We maintain the highest levels of confidentiality with secure documentation handling, discreet property evaluations, and private transaction processing to protect client privacy.

6. Can loan terms be customized for specific investment strategies?

Absolutely. We create loan structures with customized terms, payment schedules, and conditions that align with your specific investment objectives and financial strategies.

7. What types of properties qualify for exclusive private lending?

We finance luxury residential properties, oceanfront estates, commercial properties, development projects, and unique properties that require specialized underwriting and valuation.

8. Are there prepayment penalties on exclusive private loans?

Prepayment terms are negotiable and customized based on loan structure and borrower preferences. Many exclusive loans allow prepayment without penalty after an initial period.

9. Do you provide ongoing relationship management services?

Yes, we assign dedicated relationship managers to exclusive clients who provide ongoing support, market insights, and assistance with future financing needs as portfolios grow.

10. How do I begin the exclusive private lending application process?

Contact us for a confidential consultation where we’ll discuss your specific needs, property details, and financial objectives to structure the optimal lending solution for your situation.

Access Exclusive Private Lending Solutions

When your financial needs require sophisticated solutions beyond traditional banking, GAP Equity Loans provides the expertise, discretion, and flexibility that high-net-worth clients demand. Our exclusive private lending program delivers customized financing for your most important investment opportunities in Costa Rica.

Contact us today for a confidential consultation to discuss how our exclusive private lending solutions can support your sophisticated financial objectives.

- WhatsApp: +506 4001-6413

- USA/Canada toll-free: 855-562-6427

- Email: [email protected]

- Website: https://www.gapequityloans.com/

- Loan applications: https://www.gapequityloans.com/en/loan-request/

Article by Glenn Tellier (Founder of CRIE and Grupo Gap)