Economically thriving and brimming with natural beauty, Costa Rica offers landowners and investors exciting avenues…

How to get a Loan in Costa Rica: Our comprehensive guide

How to Get a Loan in Costa Rica: A Comprehensive Guide

At Gap Equity Loans, we understand that getting a loan in a foreign country can be daunting. Whether starting a new business or expanding an existing one, you may need to secure a loan to get things moving. Costa Rica isn’t just a popular tourist destination, but it’s also home to a growing number of entrepreneurs and businesses. That’s why we’ve put together this comprehensive guide to help you navigate the process of getting a loan in Costa Rica.

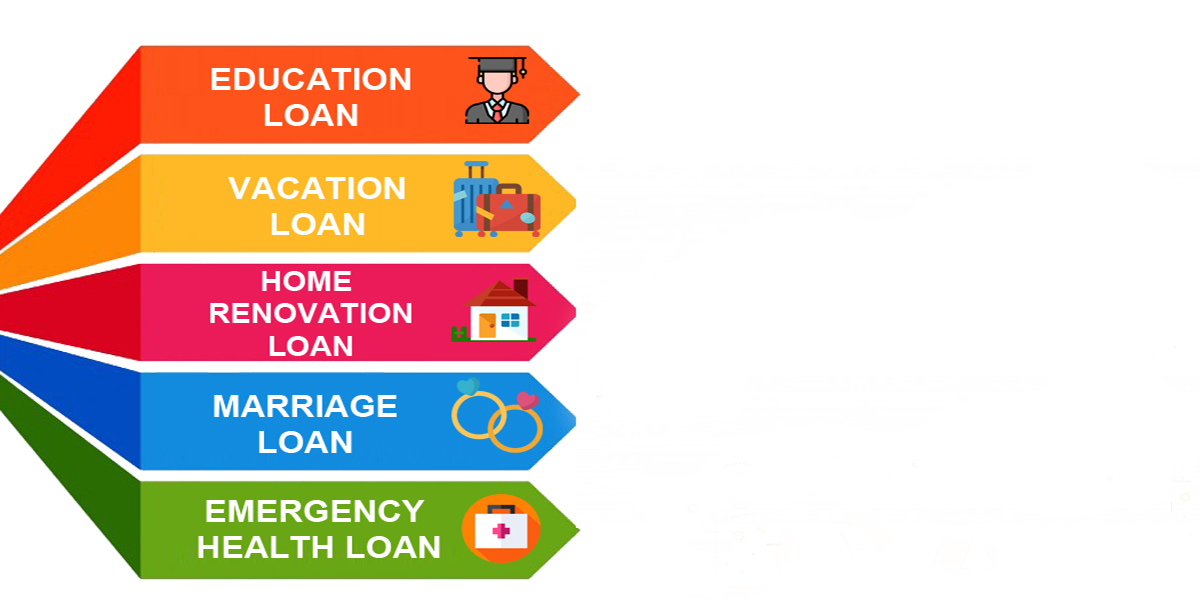

Understanding the Loan Landscape in Costa Rica

Before applying for a loan, it’s essential to understand the different types of loans available in Costa Rica. The country’s banking sector is highly developed and offers a variety of loan products, including personal loans, business loans, and mortgages. However, obtaining a bank loan in Costa Rica can be a complex process and requires the borrower to have permeant residency before applying for a loan. It’s good to understand the local loan landscape before you apply.

One of the main challenges in obtaining a loan in Costa Rica is the country’s strict lending regulations, especially for foreigners. Banks and other lending institutions must adhere to strict credit scoring and lending practices, which can make it difficult for borrowers with less-than-perfect credit to secure financing. However, alternative lending options, such as private lenders, are more flexible and offer loans at similar interest rates of 12-18% to those who might not otherwise qualify for traditional financing.

What You’ll Need to Apply for Most Loans

Before you start the loan application process, you’ll need to gather a few essential documents and information. This may include:

- Proof of income and employment

- Personal identification (such as a passport or ID card)

- Business registration and tax identification number

- Financial statements (for business loans)

- Property Collateral (for secured loans)

It’s important to note that the requirements for obtaining a loan in Costa Rica may vary depending on the type of loan and lender. Be sure to check with your lender to confirm what they need before you apply.

Note: Private lenders are generally only concerned about the collateral, and the rest of the list above is considered moot.

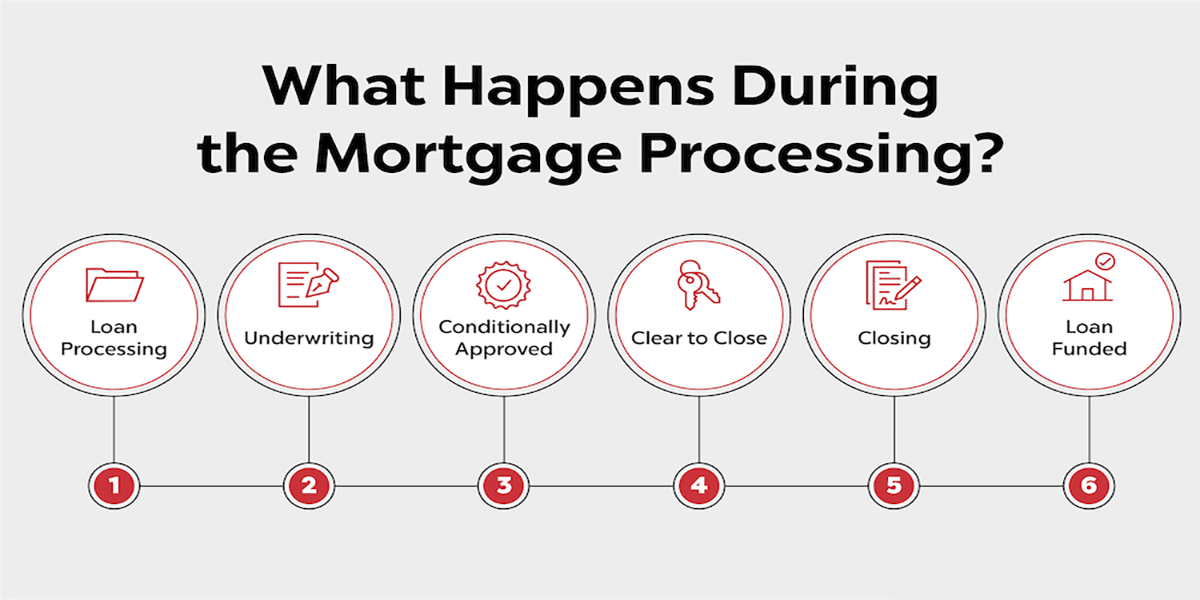

Steps to Securing a Loan in Costa Rica

Gather your documentation

To speed things up, gather all the necessary documentation before starting the loan application process, including financial statements, proof of income, Plano, photos of the property, and other relevant information.

- Choose a Lender: Costa Rica has several lending institutions, including banks and private lenders. Consider each lender’s terms and conditions, interest rates, and reputation to choose the right one.

- Complete the Loan Application: Once you’ve gathered your documentation and chosen a lender, complete the application and submit it for review.

- Wait for Approval: The lender will review your loan application and determine whether you are approved.

- Sign the Loan Agreement: Hash out if there are any last-minute revisions with the notary and lawyers present.

- Receive the Loan Fund: Begin payments according to the agreed-upon schedule.

Gap Equity Loans

Gap Equity Loans specializes in providing consulting services to potential borrowers looking for equity loans and knows how to get a loan in Costa Rica to ensure your plans come true by helping you fulfill your financial goals! We assist borrowers and lenders in navigating the loan process in Costa Rica step by step, using our knowledge and experience to help with a fair and balanced transaction.

Detailed Gap Equity Loans process

Gap Equity Loans has consolidated the following practice to bring quality, secure loans to private investors:

- Our system vets the loans initially with our Loan Request Form (pre-application);

- We check the National Registry for any legal issues or other liens on the property;

- We evaluate the exact location of the property;

- Our analyst researches comparables in the area to see if the loan request and valuation stated on the pre-application are reasonable;

- Once we establish the loan is good enough for consideration, we request the entire application;

- We verify that all the taxes are up to date, including HOA fees when applicable;

- Our consultants follow up to verify that the information is correct and establish the borrower’s ability to pay off the loan;

- We perform a site visit and take current, up-to-date photos;

- Our analyst then gives a final evaluation;

- We send the loan request out to the private lenders we work with and determine who will be funding the loan;

- We work with a borrower to make sure there is insurance on the property (if needed);

- Once a lender says “yes,” we generate a draft term sheet;

- We send it to the lawyer to verify and prepare the draft for the protocol book;

- We receive the documents and send them to the lender and borrower for review;

- The lender or borrower makes any minor tweaks or changes. Then, we sent a final draft of the term sheet to all parties;

- We coordinate the signing with the lender, borrower, lawyer, and often any other party who needs to be paid off (and their lawyer);

- We meet at an agreed-upon location to sign the protocol book. The lender distributes the funds by SINPE (local bank transfer) or certified checks;

- Now that the loan is in place, the lawyer should check the National Registry within 30 days to ensure the loan is recorded correctly.

Conclusion

Whether you choose a mortgage, private lender, bank loan, or cash purchase, it’s important to carefully consider your options and choose the one that best suits your needs and financial situation. By following the steps outlined in this comprehensive guide, you can take control of your financial future and achieve your goals in Costa Rica.

At Gap Equity Loans, we pride ourselves on giving our clients the information they need to make informed decisions about their loans. With our comprehensive guide to getting a loan in Costa Rica, you’ll know to navigate the loan process confidently. Contact us today to learn more about our loan options and how we can help you achieve your financial goals.

Is it legal for expats to buy property in Costa Rica?

Yes, it is legal for expats to buy in Costa Rica.

How much do the taxes on property cost in Costa Rica?

In Costa Rica, property taxes are usually around 0.25 percent of the property’s assessed value.

I live in Costa Rica. Can I get a mortgage?

Yes, expats can get mortgages in Costa Rica. But the interest rates and requirements may differ from what you’re used to back home.

How long does it take in Costa Rica to buy a house?

How long it takes to buy a home in Costa Rica depends on many things, like the type of property, where it is, and any legal requirements. Usually, the process takes between a few weeks and a few months.

How much does it cost to close a property in Costa Rica?

When you buy a home in Costa Rica, you may have to pay legal fees, transfer taxes, registration fees, and other paperwork-related costs.

Do I need a lawyer to buy a house in Costa Rica?

You don’t have to hire a lawyer when buying property in Costa Rica, but it’s a good idea. A lawyer can help you determine what the law says and ensure your deal is legal.

Can I rent out my Costa Rican home?

Yes, in Costa Rica, you can rent out your home. But you might need to get a business license and pay taxes on the money you make from renting it out. Learning the local rules and laws about renting out homes is essential.

Contact us for more information, or fill out a loan request now!

Need Residency status in Costa Rica? – Click HERE.

Looking for Real Estate? – Click HERE.

Want to invest? – Click HERE.

Article by Glenn Tellier (Founder of CRIE and Grupo Gap)

This Post Has 0 Comments